Follow us on:

|

Latest

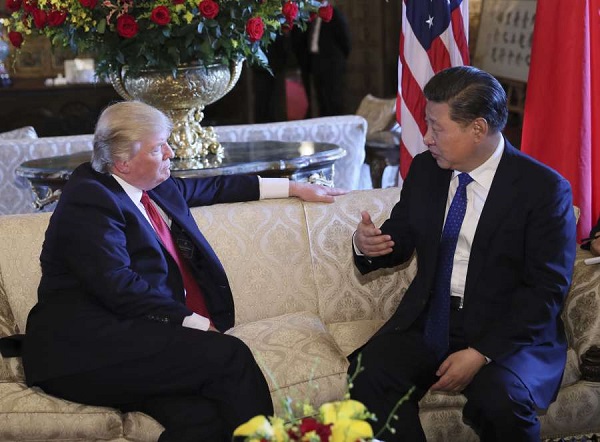

File photo of US President Donald Trump with Chinese President Xi Jinping

International Monetary Fund chief Christine Lagarde has called on China and the US to resolve their looming trade disputes through the use of existing multilateral provisions and organizations.

Both countries have been locked in a war of words and threats over US President Donald Trump’s decision to impose substantial tariffs on Chinese goods entering US markets. China has responded by doing the same, largely focused on agricultural industries in the American heartland.

Trump responded by increasing the scope of Chinese products to be hit with tariffs – to $150 billion – in a tit-for-tat exchange between the two economic powers.

In recent weeks, however, both countries have hunkered down with neither moving forward on their threats as economists warn that a trade war would be a lose-lose scenario for both countries.

A trade war would be disastrous for global economies as well; these have only now started to show sustained growth following the global financial crisis on the back of the sub-prime mortgage crisis in the US.

Lagarde said that the United States and China should work on the basis of free trade and within the framework of the rules-based multilateral institutions.

Meanwhile, Chinese officials with the Ministry of Commerce have welcomed reports that the U.S. Treasury Secretary Steven Mnuchin is considering making a trip to China to discuss economic and trade issues.

“I did meet with the Chinese here. The discussions were really more around the governor’s actions at the PBOC (People’s Bank of China) and certain actions they’ve announced in terms of opening some of their markets, which we very much encourage and appreciate,” Mnuchin told reporters on the sidelines of an IMF meeting in Washington on Saturday.

The BRICS Post with inputs from Agencies

© 2017 BRICS Media Limited. All rights reserved. Registered in England and Wales. No.8133697. Registered office: Devonshire House 60 Goswell Road London, EC1M 7AD

57 founding members, many of them prominent US allies, will sign into creation the China-led Asian Infrastructure Investment Bank on Monday, the first major global financial instrument independent from the Bretton Woods system.

Representatives of the countries will meet in Beijing on Monday to sign an agreement of the bank, the Chinese Foreign Ministry said on Thursday. All the five BRICS countries are also joining the new infrastructure investment bank.

The agreement on the $100 billion AIIB will then have to be ratified by the parliaments of the founding members, Chinese Foreign Ministry spokesman Lu Kang said at a daily press briefing in Beijing.

The AIIB is also the first major multilateral development bank in a generation that provides an avenue for China to strengthen its presence in the world’s fastest-growing region.

The US and Japan have not applied for the membership in the AIIB.