Follow us on:

|

If it’s a trade war you want, it’s a trade war you’re going to get …

… but global investors won’t be happy.

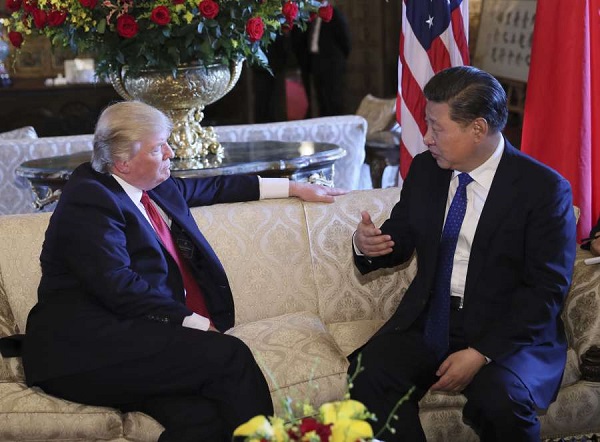

File photo of US President Donald Trump with Chinese President Xi Jinping

China has fired back at the US on Wednesday calling a list of some 1,200 Chinese products drafted by Washington for fresh tariffs as “the grossest violation of the [World Trade Organization] rules”.

The list, released Wednesday, includes hundreds of high-tech products, and is designed to curb China’s quest towards global technological superiority.

European traders returned from a four-day Easter holiday on Tuesday to find that major indices had taken a plunge in line with US stocks a day earlier over fears of a China-US trade war.

London’s benchmark FTSE 100 fell but recovered slightly to close at -0.37 per cent.

In Paris, the CAC 40 dropped 0.29 per cent, while in Frankfurt, the DAX had its worst April start in years, falling 0.78 per cent.

On Monday, Beijing made good on its pledge to execute a number of countermeasures against US president Donald Trump’s late March tariffs on Chinese Imports.

It immediately slapped counter-tariffs on 120 US products that had enjoyed considerable market status in China.

These included pork and fruit.

China is the third largest market for American pig farmers with their exports accounting for $1.1 billion in sales.

“The Customs Tariff Commission of the State Council has decided to impose a tariff of 15 percent on 120 items of products imported from the United States including fruits and related products, and a tariff of 25 percent on eight items of imports including pork and related products from the country,” said a statement from the Chinese Ministry of Commerce.

Trump says that his tariffs on $60 billion worth of Chinese products is designed to reduce a trade deficit between the two countries, which currently stands at about $340 billion, and which the president blames on unfair trading practices from Beijing.

But the Chinese retaliation sent US stocks into a dive.

The Dow Jones Industrial Average fell 1.9 per cent, to end at 23,644.19 while the S&P 500 fell 2.23 per cent, and the Nasdaq Composite plunged 2.74 per cent.

The latest hit to the New York Stock Exchange put the three benchmark indices in the red since January 1st of this year.

Despite the recovery stateside on Tuesday, the hit to tech stocks bit into Asian markets after a good performance on Monday.

On Tuesday, Japan’s Nikkei slipped 0.29 per cent but recovered 0.13 per cent on Wednesday.

China’s Shanghai Composite took a 0.84 plunge.

South Korea’s Kospi changed little, in the red 0.07 per cent, while Hong Kong’s Hang Seng maintained Monday’s positive outlook and rose 0.29 per cent.

So far, China’s retaliation appears limited to minimal damage even though it is targeting America’s agricultural heart – specifically by slapping tariffs on soybeans.

The Chinese are hoping to limit the scope of their retaliatory measures likely to persuade the Trump administration to back off. However, on Wednesday Chinese officials said they would respond with equal scope and ferocity to new US measures.

The BRICS Post with inputs from Agencies