Follow us on:

|

Hard to measure services sector revisions make technical recession disappear

Is the South African economy on the rise again? [Xinhua]

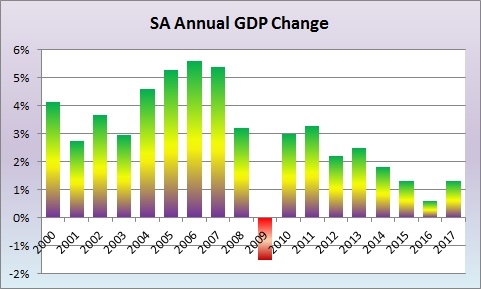

Statistics South Africa estimated that 2017 gross domestic product (GDP) growth was in fact 1.3 per cent. Revisions to the hard to measure services sector also resulted in the fourth quarter 2016 quarterly contraction first estimated at a 0.3 per cent annualised contraction has now been transformed into a 0.4 per cent expansion.

The first quarter 2017 still remains as a contraction, but as the usual definition of a technical recession is for two consecutive quarters of quarterly contractions, the 2016/17 recession is no more.

The service sectors that were responsible for this good news were the wholesale, retail and motor trade; catering and accommodation sector; the transport, storage and communication sector, the finance, real estate and business services and lastly general government services. The new quarterly growth rates in per cent for the fourth quarter 2016 (with old estimate in brackets) are: 2.5 (2.1); 3.1 (2.6); 2.6 (1.6) and 1.2 (0.9).

This meant that the annual growth for 2016 was doubled to 0.6 per cent from the previous estimate of 0.3 per cent .

Given the difficulty of estimating service sector value add, economists query why the annual growth rate in the transport, storage and communication sector is only 1.5 per cent in 2017 from 0.8 per cent in 2016, as land transport payload tonnage grew by 9.3 per cent in 2017 due to the record maize harvest after a small 2.2 per cent gain in 2016, while communication companies reported double-digit increases in data usage in both years.

The better than expected GDP growth rate is not unique to South Africa as most countries in the world have exceeded economists’ forecasts as shown by the consensus forecasts from UK-based Consensus Economics (www.consensuseconomics.com). The US for instance has had its 2018 GDP growth forecast increased from 2.4 per cent in January 2017 to 2.7 per cent in January 2018, while Germany has moved from 1.8 per cent to 2.3 per cent over the same period.

The better than expected GDP growth rate is not unique to South Africa as most countries in the world have exceeded economists’ forecasts as shown by the consensus forecasts from UK-based Consensus Economics (www.consensuseconomics.com). The US for instance has had its 2018 GDP growth forecast increased from 2.4 per cent in January 2017 to 2.7 per cent in January 2018, while Germany has moved from 1.8 per cent to 2.3 per cent over the same period.

France has been upgraded to 1.9 per cent from 1.6 per cent, while Japan’s GDP growth forecast has improved from 1.1 per cent to 1.4 per cent.

Only the UK has remained stagnant at 1.4 per cent.

The stronger developed countries’ growth bodes well for BRICS growth as most economies need improved exports to boost their economies in 2018, so the optimistic forecast that growth could exceed 2 per cent this year made by former Finance Minister Malusi Gigaba in East London in January now looks achievable.

Helmo Preuss in Grahamstown, South Africa for The BRICS Post