Follow us on:

|

![South African Finance Minister Pravin Gordhan has said that emerging economies like BRICS have had to bear the burden of slowing growth in the developed world [AP]](http://thebricspost.com/wp-content/uploads/2014/02/GORDHAN-AP.jpg)

South African Finance Minister Pravin Gordhan has said that emerging economies like BRICS have had to bear the burden of slowing growth in the developed world [AP]

Real gross domestic product (GDP) growth slowed to 1.9% in 2013 from 2.5% in 2012 and 3.6% in 2011 according to Statistics South Africa data released on February 25.

Sanlam Investments economist Arthur Kamp said the household tax burden has already increased from 12% in 2007 to 15% in 2012. Slowing growth momentum and rising cost pressures suggest that the tax burden will have to increase further, even if government expenditure remains under control, which has been the experience of the past few years.

Real non-interest government spending growth slowed from 4.2% in the 2011/12 fiscal year, which ends in March in South Africa, to 2.2% in 2012/13 and an expected 2.1% in 2013/14.

The Treasury’s Medium Term Expenditure Framework released in October 2013 forecast a small rise to 2.6% growth in 2014/15, as that is an election year with the national and provincial elections taking place on May 7, before easing to 2.1% in 2015/16 and 1.6% in 2016/17.

Revenue growth in the first nine months of the current fiscal year have been ahead of target and grew by 11.6% year-on-year compared with a target of 10.4% increase for the full fiscal year. The January 2014 revenue and expenditure figures will be released on February 28.

Meanwhile, the first two months of 2014 have been marked by strikes in the platinum sector, as well as a week-long interruption to the power supply at Richards Bay Coal Terminal, which resulted in a loss of opportunity of at least R1 billion in export revenue for the week. This could, however, be made up in March as the recent throughput of 70 million tons per annum has been below design capacity of 90 million tons per annum.

Economists at different financial institutions have put forth their expert views ahead of Gordhan’s budget on Wednesday.

Sanlam Investments economist Kamp noted that the Treasury has four policy options, namely it can cut spending, increase taxes, sell assets or live with larger fiscal deficits and higher debt levels.

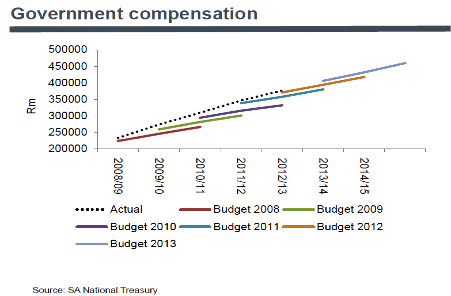

He said the government wage bill absorbs 40% of government revenue, as government employment is 25% of total employment. For Kamp, a worrying aspect of previous Budgets has been that multi-year forecasts for the wage bill have continually come in below actual spending on the wage bill.

Meganomics economist Colen Garrow said a relatively simple way to cut the fiscal deficit would be to raise the Value Added Tax (VAT) rate from the current 14% to 15%, but he doubted that would be politically an option in an election year. In his view the tax burden had to increase to better balance the government’s books.

Investec economist Anabel Bishop said given that the South African Reserve Bank increased the repo rate by 50 basis points to 5.5% in January 2014, Treasury is likely to revise down its real GDP forecasts for this year and next year from the October 2013 forecast of 2.4% in 2014, and 2.8% in 2015.

She noted that while the South African government has been spending counter-cyclically to support economic growth and job creation since the 2008/9 recession, the Treasury has warned that if tax revenues do not meet expenditure requirements, tax hikes could occur.

In her view the substantial rise in the number of civil servants and in their remuneration has bulked out government expenditure and contributed to the rise in debt and deficit levels. The likely downward revision of National Treasury’s 2014 to 2016 economic growth forecasts will be negative for the budget deficit projections post 2013/14 as expenditure will not be cut, merely real (taking inflation into account) growth in expenditure. South Africa has a very small tax base and any increase in taxes this year or over the medium-term would suppress already weak economic growth and accelerate job losses in the formal private sector.

South African Institute of Chartered Accountants (Saica) Tax Suite project director Somaya Khaki said the important role small businesses in South Africa play in growing the country’s economy and overcoming unemployment should not be underestimated.

Saica has asked the Treasury to consider further tax relief and incentives for small and medium businesses as a means of stimulating economic growth. Several years ago, accelerated capital allowances and concessionary tax rates were introduced for small businesses, while more recently the gross taxable income threshold for small businesses was raised, but from a VAT perspective, the administrative burden and compliance issues related to small businesses was in many instances no less than those applicable to larger businesses.

In practice, the 2014/15 Budget is likely to put more emphasis on raising taxes than the other three policy options, as there is already minimal spending growth, selling assets is uncertain, and the credit ratings and foreign investors will punish any rise in government debt levels.

Helmo Preuss in Pretoria for The BRICS Post