Follow us on:

|

In his maiden Medium Term Budget Policy Statement (MTBPS), Finance Minister Tito Mboweni started his speech with a quote from Charles Dickens’ “A Tale of Two Cities”.

The MTBPS is a central part of fiscal planning and is designed to outline how South Africa spends scarce resources for the benefit of all South Africans

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity… we were all going direct to Heaven, we were all going direct the other way…”.

Mboweni said that is very similar to where South Africa finds itself today.

“As a country, we stand at a crossroads. We can choose a path of hope; or a path of despair. We can go directly to Heaven, or as Dickens so politely puts it, we can go the other way. For ordinary South Africans, it has become a difficult time. Administered prices, such as electricity and fuel, have risen. Unemployment is unacceptably high. Poor services and corruption have hit the poor the hardest. Under the leadership of our President, and much like the central character in A Tale of Two Cities, we have, as a country, chosen the difficult path of redemption,” Mboweni said.

He noted that the MTBPS is a central part of our planning as a country and this was the 22nd iteration. It is designed to outline how we spend scarce resources for the benefit of all South Africans.

“This Policy Statement provides us with an opportunity to take stock of the strides we have taken in the year. We do this in a data driven way, providing credible evidence to judge our collective performance as a society. However, it is more than a set of numbers, reams of data, charts, graphs or words. Our performance should be measured by whether people are gainfully employed, whether our children are learning in decent schools, and whether we have health care facilities that are up to standard,” he said.

He added that the MTBPS was an opportunity to restore trust between government and society.

“South Africans correctly expect more from their government. They are right to expect that their money is spent wisely and productively, and goes to meeting their basic needs,” he said.

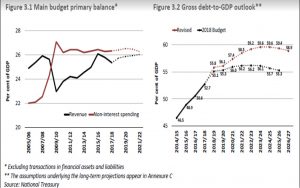

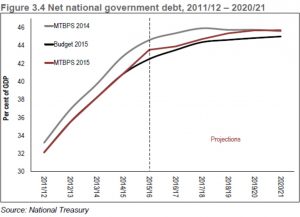

In the MTBPS itself, the Treasury said the government remains committed to fiscal sustainability, but there has been fiscal slippage since the 2018 Budget.

“Tax revenues have been revised down, partly due to higher value-added tax refunds. Despite spending pressures materialising, the expenditure ceiling remains intact as the anchor of fiscal policy. The consolidated budget deficit narrows from 4.2 per cent in 2019/20 to 4.0 per cent in 2021/22. Gross debt is expected to stabilise at 59.6 per cent of GDP in 2023/24,” Treasury said.

This compares with the plateauing at 52.6 per cent expected in 2021/22 in the February 2018 Budget. This will not please the ratings agencies as fiscal consolidation keeps on being pushed out or in other words, the can just gets kicked further down the road.

This slippage is most evident when we compare it with the 2015 MTBPS.

The Treasury expects only 8.3 per cent growth in tax revenue in this fiscal year even though tax revenue grew by 11.2 per cent y/y in the first five months.

Even with the slow revenue growth that Treasury projects, the call on the domestic bond market will be reduced to R175.5bn from the R191bn given in the February 2018 Budget. This is in large measure due to the increase in foreign loans to R53.8bn from R38bn in the Budget as Treasury will issue another US$2bn bond before the end of March 2019

“The President’s economic stimulus and recovery plan is intended to address the country’s most pressing challenges: anemic economic growth and high unemployment. The initiative includes an infrastructure fund to be developed in partnership with the private sector, reforms to enhance economic growth and improve governance, and support for urgent education and health needs,” the MTBPS said.

The JSE All-Share index finished 0.6 per cent lower at 50,877.34, while the rand weakened to R14.48 per US dollar in late afternoon trade after being at R14.17 at midday prior to the speech. The benchmark R186 government bond yield was quoted at 9.325 per cent at the JSE close compared with 9.14 per cent late on Tuesday.

Nedbank chief economist Dennis Dykes said the reaction of ratings agency Moody’s would be key as that it is the only ratings agency that still rates South African government as investment grade.

“Moody’s recently delayed its decision and has generally been portraying a positive picture of South African prospects. However, the fiscal trajectory is considerably worse than they have been anticipating and there is therefore a greater risk of a downgrade or a change to a negative outlook in the short term. The hope is that they wait for the main budget next February as well as the elections expected in May,” Dykes said.

Helmo Preuss in Pretoria for The BRICS Post