Follow us on:

|

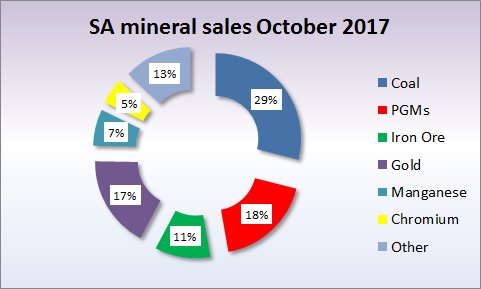

Coal is the largest contributor with a 29 per cent share

South Africa ranks as one of the richest countries in natural resources from gold to iron ore [Image: Archives]

The statistical agency said that from next month’s release there would no longer be a month lag between mineral sales and mining production, as it also released November mining production data. At the February release both December mineral sales and mining production would be shown. Stats SA is also looking to re-introduce the reporting of mineral export sales.

The 14.3 per cent y/y increase in mineral sales was due in part to the 30.7 per cent y/y surge in October to a record bulk export volume of 16.7 million tonnes. This eclipsed the previous record of 16.4 Mt set in January 2015. The October 2017 record was set despite a severe storm that disrupted port operations along South Africa’s eastern coast.

The main contributors to the October mineral sales increase were manganese ore (up 84.6 per cent) iron ore (up 41.3 per cent), gold (up 18.4 per cent) and coal (up 14.0 per cent).

Mining production surprised on the upside in November with a 6.5 per cent y/y increase after a 5.2 per cent y/y gain in October. The consensus forecast had been for slowdown to a 4.9 per cent y/y rise. Output advanced at a faster pace for: coal (8.5 per cent from 6.2 per cent in October); platinum group metals (12.3 per cent from only 0.6 per cent) and iron ore (20.7 per cent from 17.9 per cent).

The strong volume and value growth has resulted in international investors once again buying South African mining companies such as Anglo American, whose share price breached R300 this week for the first time since 2012.

Mining production is up 4.4 per cent y/y in the first eleven months of 2017 and the value of mineral sales is up 9.9 per cent y/y in the first ten months of 2017.

Despite the strong growth in 2017, economists say policy uncertainty has hampered mining investment as a typical deep level gold mine such as South Deep has a 50-year life span and can take more than four years and many billions of rand to develop before it delivers its first production.

That is why South Africa keeps on slipping down the ranks of gold mining countries. It used to be the world’s largest producer of gold for more than a century after the discovery of gold on the Witwatersrand in 1886.

A Chamber of Mines survey released last month asked its members to assess as to what impact a better regulatory environment would have on investment plans. The response was that that capital expenditure on mining projects could be 84 per cent higher than the current R145bn resulting in 48,000 more jobs.

The reality of the past few years however is that the industry has lost 70,000 jobs over the last five years, while capital Investment in mining has been stagnant since 2009. This is mostly maintenance investment with the result that net investment has declined by 57 per cent since 2008.

However it is not just policy uncertainty that poses a constraint. The operational efficiency of state-owned enterprises such as logistics company Transnet and electricity supply company Eskom have hampered efficient mining operations and prevented South Africans from reaping the rewards of bountiful geological riches.

The two new coal-fired power stations of Medupi and Kusile for should have been finished in 2015 according to Eskom’s 2009 plan, yet both are not finished with the last unit unlikely to be in commercial operation before 2022, double the original project time.

Policy uncertainty and logistics constraints meant that South Africa lost out on the 2003 to 2008 commodity price boom with annual bulk exports increasing by a mere 2.8 Mt between those two years.

Since then there has been a marked turnaround due to better policy co-ordination between mining companies and state-owned Transnet, so that volumes have improved by 45 per cent or 52.3 Mt between 2008 and 2015, but policy uncertainty about mineral rights and share ownership is hampering capacity expansions.

Helmo Preuss in Grahamstown, South Africa for The BRICS Post