Follow us on:

|

![Spending in South Africa grew at an annualised 3.4 percent in the first quarter of the year after rising 0.3 percent in the previous quarter, boosted by a faster pace of consumption by households, the central bank said on Tuesday [Xinhua]](http://thebricspost.com/wp-content/uploads/2015/06/e7326c67-a66b-4ea6-bdc0-e7251a2660f5.jpg)

Spending in South Africa grew at an annualised 3.4 percent in the first quarter of the year after rising 0.3 percent in the previous quarter, boosted by a faster pace of consumption by households, the central bank said on Tuesday [Xinhua]

The narrowing was in large measure due to dividend inflows as reflected in the income receipts category.

Income receipts jumped to R37.231bn in the first quarter 2015 from only R17.308bn in the fourth quarter 2014.

A similar first quarter jump was visible last year when income receipts rose to R25.065bn in the first quarter 2014 from only R10.34bn in the fourth quarter 2013.

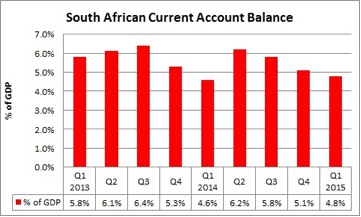

The rand has weakened considerably over the past year versus the US dollar as a current account deficit near 6 per cent was seen as unsustainable.

The rand has weakened considerably over the past year versus the US dollar as a current account deficit near 6 per cent was seen as unsustainable.

Economists had expected the current account deficit to be little changed from the fourth quarter.

The sharper than expected narrowing should provide some support for the rand.

In addition an increase in the national savings rate from 14.7 per cent in the third quarter to 15.3 per cent in the fourth quarter and 16.2 per cent in the first quarter meant that there was less call on foreign funding of fixed investment.

The foreign finance ratio, measuring the country’s dependency on foreign capital to finance gross capital formation, decreased from 28.5 per cent in the third quarter 2014 to 25.0 per cent in the fourth quarter 2014 and 22.7 per cent in the first quarter 2015.

On annual basis, the current account deficit narrowed to 5.4 per cent of GDP in 2014 from 5.8 per cent of GDP in 2013 and 5.0per cent in 2012. It was only 1.5 per cent in 2010 and the government is forecasting a further narrowing to 4.5 per cent in 2015.

Widening current account deficits mean that the country’s domestic production is unable to keep pace with domestic demand, so South Africa’s real GDP growth rate as measured from the production side has slipped from 3.2 per cent in 2011 to 2.2 per cent in 2013 and 2012 and only 1.5 per cent in 2014.

The government is forecasting 2.0 per cent growth in 2015.

South Africa as a small open economy has a large exposure to its foreign trade sector with exports of goods and services accounting for 31.3 per cent of GDP in 2014, while imports have a 33.7 per cent share of GDP.

In the recession year of 2009, exports only accounted for 27.9 per cent of GDP, while imports had a 27.5 per cent share.

Helmo Preuss in Pretoria, South Africa for The BRICS Post